With enthusiasm, let’s navigate through the intriguing topic related to Income Tax Brackets 2026: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

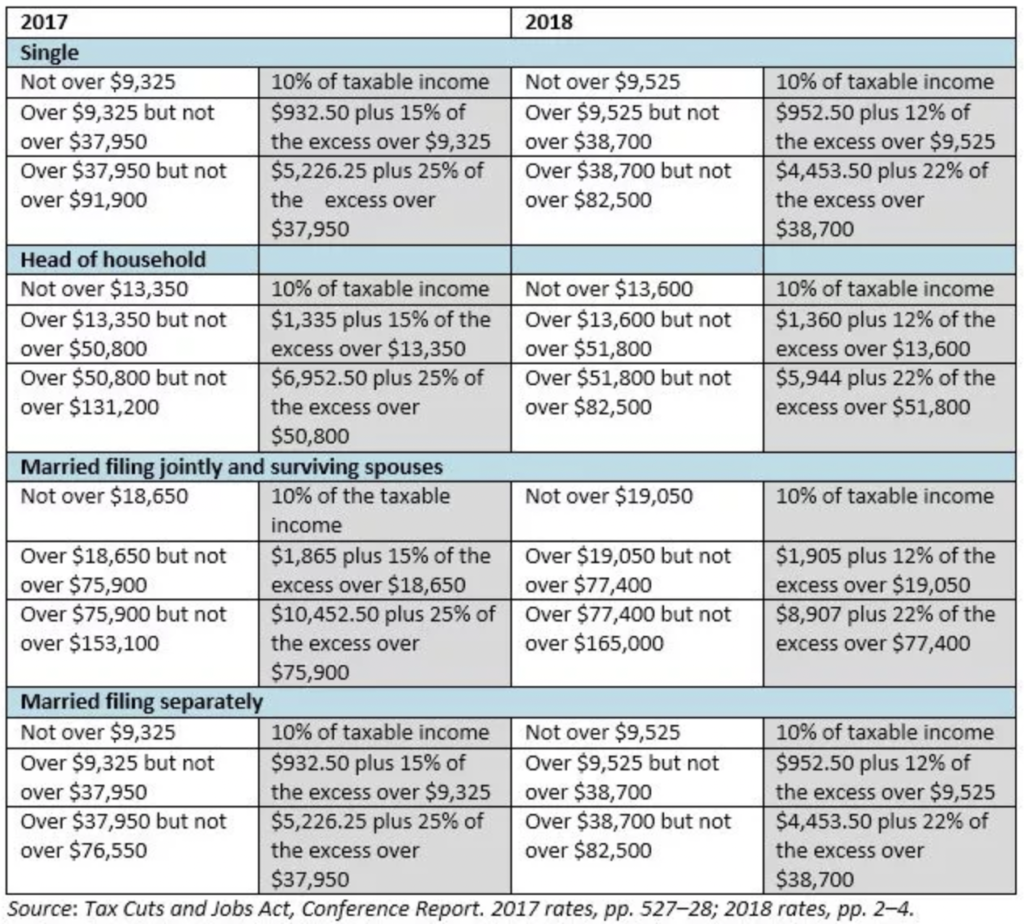

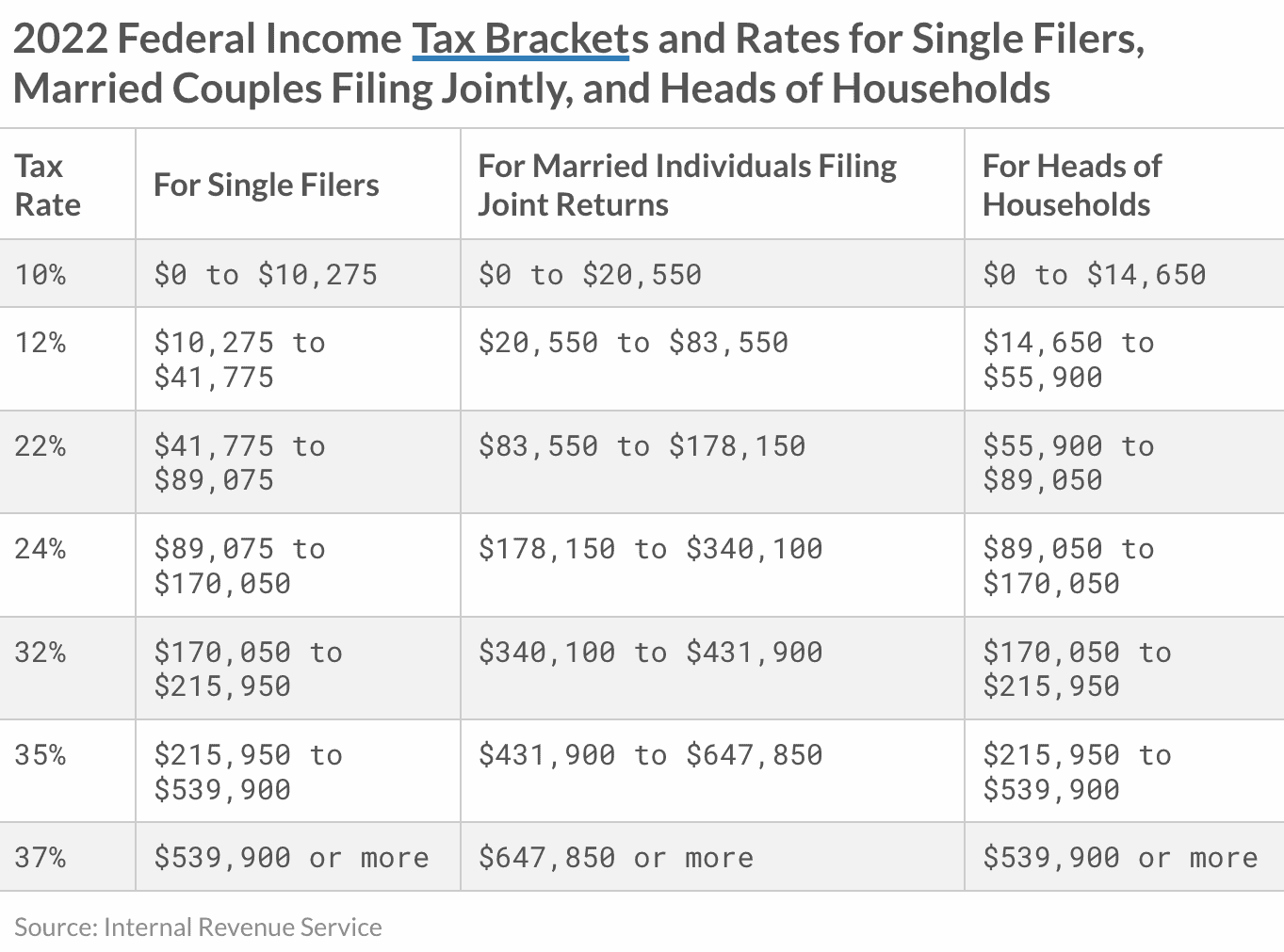

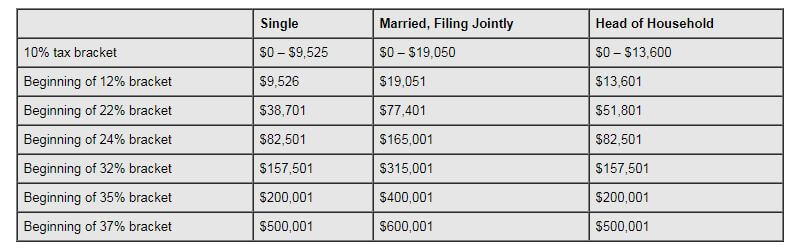

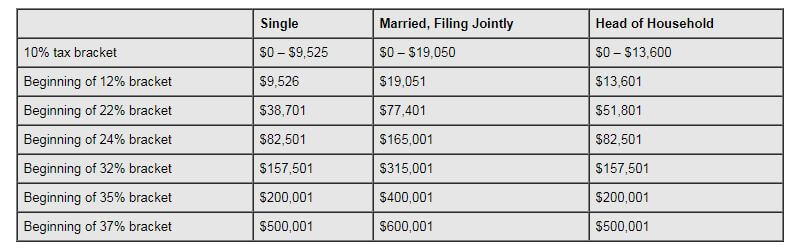

The United States income tax system is a progressive tax system, meaning that the higher your income, the higher the percentage of your income you pay in taxes. The tax brackets for 2026 have been adjusted for inflation and will be as follows:

The standard deduction for 2026 will be $12,950 for single filers, $25,900 for married couples filing jointly, $12,950 for married couples filing separately, and $20,800 for heads of household. The personal exemption has been eliminated.

Your taxable income is your total income minus your allowable deductions and exemptions. Common deductions include the standard deduction, itemized deductions, and the earned income tax credit.

You can file your taxes online, by mail, or through a tax preparer. If you file online, you can use the IRS Free File program to file your taxes for free.

If you do not file your taxes on time, you may be subject to penalties. The penalty for not filing your taxes on time is 5% of the unpaid tax for each month that your return is late, up to a maximum of 25%.

The income tax brackets for 2026 have been adjusted for inflation. The standard deduction and personal exemption have also been adjusted. If you have any questions about your taxes, you should consult with a tax professional.

Thus, we hope this article has provided valuable insights into Income Tax Brackets 2026: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!